Mary Lyn Hammer’s Comments on Negotiated Rulemaking for Higher Education

Read at Regulations.gov

U.S. DEPARTMENT OF EDUCATION

ATTN: Jean-Didier Gaina

400 Maryland Ave., SW, Room 6W232B,

Washington, DC 20202

RE: Docket ID ED-2015-OPE-0103

Dear Ms. Gaina,

I write to you as a concerned American taxpayer who has watched the systematic assault on proprietary schools over the last seven years. I and many others see as this assault as planned. I welcome the opportunity to comment on the above referenced proposed federal regulations for “defense to repayment.”

To begin, please review the original roles and purposes of the Department and compare that intent to what it has become today. A stark difference has emerged that does not appear to be serving or supporting the original intent of the U.S. Department of Education (“Department” or “ED”) defined in its MISSION as follows:

ED’s mission is to promote student achievement and preparation for global competitiveness by fostering educational excellence and ensuring equal access.

Congress established the U.S. Department of Education (ED) on May 4, 1980, in the Department of Education Organization Act (Public Law 96-88 of October 1979). [1] Under this law, ED’s mission is to:

- Strengthen the Federal commitment to assuring access to equal educational opportunity for every individual;

- Supplement and complement the efforts of states, the local school systems and other instrumentalities of the states, the private sector, public and private nonprofit educational research institutions, community-based organizations, parents, and students to improve the quality of education;

- Encourage the increased involvement of the public, parents, and students in Federal education programs;

- Promote improvements in the quality and usefulness of education through Federally supported research, evaluation, and sharing of information;

- Improve the coordination of Federal education programs;

- Improve the management of Federal education activities; and

- Increase the accountability of Federal education programs to the President, the Congress, and the public.

I am alarmed by the Department’s departure from its mission which is blatantly evident in this proposed rule. Nowhere in the Department’s mission is any definition that could remotely be construed as authoritarian where the Department has been awarded the discretion to choose cases to bring forward (federal attorney), then decide who the hearing officer is (choose their own judge), then argue the cases (prosecutor) in front of their hearing officer of choice, and then decide the punishment (jury). Not only are the contents of this proposed rule a departure from the Department’s defined mission, it is also an alarming departure from the legal structure in America that assumes innocence until proven guilty; ensures that the accused is allowed to have a hearing in front of an unbiased selection of peers; and ensures that the terms and provisions of the Constitution are upheld.

Under these proposed rules, which also appear to be aimed primarily at proprietary schools, the following is evident:

- The Department has made itself the single authority for reviewing, organizing and bringing forth claims against schools giving itself broad discretion and complete control over every aspect of these cases. This includes organizing “classes” of litigants to bring claims even if those students themselves have not made a claim against the school. The students can be put into litigation classes without their knowledge or approval and the Department can use a students’ personal information in the claim without their knowledge or consent.

- The Department has redefined the meaning of “fraud”. Fraud is traditionally defined as “A false representation of a matter of fact—whether by words or by conduct, by false or misleading allegations, or by concealment of what should have been disclosed—that deceives and is intended to deceive another so that the individual will act upon it to her or his legal injury.”

“Fraud must be proved by showing that the defendant’s actions involved five separate elements: (1) a false statement of a material fact,(2) knowledge on the part of the defendant that the statement is untrue, (3) intent on the part of the defendant to deceive the alleged victim, (4) justifiable reliance by the alleged victim on the statement, and (5) injury to the alleged victim as a result.” [2] In these rules, the Department does not require “injury” or “damage” as a mandatory component of the claims. A student could have graduated, be working in the field of study, and earn within range of the earnings disclosed by the school yet still be allowed to file a claim or be included by the Department in a “class” of litigants for discharge of his or her student loan debt without his or her knowledge or consent.

- Schools have little if any options for appealing or offsetting the costs of frivolous claims, which are definitely expected to be filed. Schools have no way of reversing the damage to their reputations resulting from the “presumed guilty” nature of these regulations—once the schools have endured negative publicity from a frivolous claim, the damage has been done.

- The proposed regulations subject schools to “double jeopardy” which is strictly prohibited by the Constitution because individuals who lose a claim under a “class” have been given the right to file another claim as an individual, thus giving them two chances to file claims.

The egregious departure from the Department’s mission has also been identified by elected officials and media outlets alike.

The joint statement below was released by the House Education and the Workforce Committee Chairman, John Kline (R-MN), and Higher Education and Workforce Training Subcommittee Chairwoman, Virginia Foxx (R-NC), on the same day that the Department published the advance draft of the NPRM.

“When a school commits fraud against a student, there should be a fair process in place to hold the school accountable and provide relief to students. Congress has given the administration the tools it needs to do just that, and the administration has been urged time and again to use those tools in a responsible way. Yet once again, the department is rejecting the reasonable approach for an extreme, partisan approach. This vague and subjective regulatory scheme—which totals more than 500 pages—threatens to ensnare institutions that are following the law and serving the best interests of their students. Taxpayers will be on the hook for billions of dollars in discharged loans, and ultimately, students will have a harder time accessing the education they need to succeed in life. This proposed regulation should be withdrawn and current protections for students should be enforced in a fair, responsible manner.”

A Wall Street Journal article titled Obama’s Student Loan Writeoff—First target for-profit schools, then have taxpayers pay the bill [3] stated:

“The new proposal would allow borrowers to discharge loans if a court renders a legal judgment against their college or if their school breached a contract. The department also wants to make borrowers eligible if their college made a ‘substantial misrepresentation.’ This is defined as ‘any statement that has the likelihood or tendency to mislead under the circumstances’ or ‘omits information’ and on which that person ‘could reasonably be expected to rely, or has reasonably relied, to that person’s detriment.’

“This would vastly expand the basis for debt relief since nearly all ads can be defined as misleading under some circumstance. Government bureaucrats would play King Solomon and oversee a tribunal—which means a rubber stamp.

“The Secretary of Education could also certify claims for groups of borrowers with “common facts and claims.” A “department official” would represent borrowers pro bono. Another government solon would review “the basis for identifying the group,” resolve claims and determine the liability of a college for discharged loans. This quasi-judicial system would eviscerate due process.”

Wall Street Journal published an article titled The For-profit Kill Zone [4] on June 22, 2016 and stated:

“When it comes to for-profit colleges, the Obama Administration seems to be taking its cues from ancient Roman politics. It isn’t enough to kill the schools, you have to kill their accreditor too. Witness the campaign to yank recognition from the Accrediting Council for Independent Colleges and Schools (ACICS) for the sin of accrediting colleges on the Obama destruction list.”

Two years ago, The Blaze Magazine saw what was coming and published an article titled Obama Wants To Wreck For-profit Education and the Mainstream Media Want To Help [5]

“Education for profit is new and innovative, so naturally it’s controversial. But, honestly, who cares about ivy-covered walls when you are trying to get a degree in some cutting-edge technology?

“Traditional colleges care. They are used to having a monopoly on education. And those union-staffed, bastions of liberalism have their hooks into government more under the Obama administration than any time in recent memory.

“Only to maintain their power, they have to shut down competition. They are trying to accomplish that by saying that for-profit colleges don’t provide students with “gainful employment.” That mindset has pushed the administration into creating rules that harm for-profit institutions even when traditional colleges might fail the same measures.”

… “What was especially strange was that journalists seemed to care little about the very people for-profit education is designed to help—students. More importantly, students that traditional colleges tend to underserve because they lacked the money, connections or opportunities for a standard four-year degree.

“Ordinarily, journalists are the ones screaming when poor and working class people get a raw deal. Instead, they are trying desperately to make it happen. The result could be ‘as many as 7.5 million students losing aid,’ according to a new 100-page economic assessment by the industry.”

… “Imagine the media reaction if even 4 percent of students at traditional colleges might face that fate.

“But if you attend for-profit schools, you don’t matter much to the administration or the journalists who are supposed to be keeping them in check.”

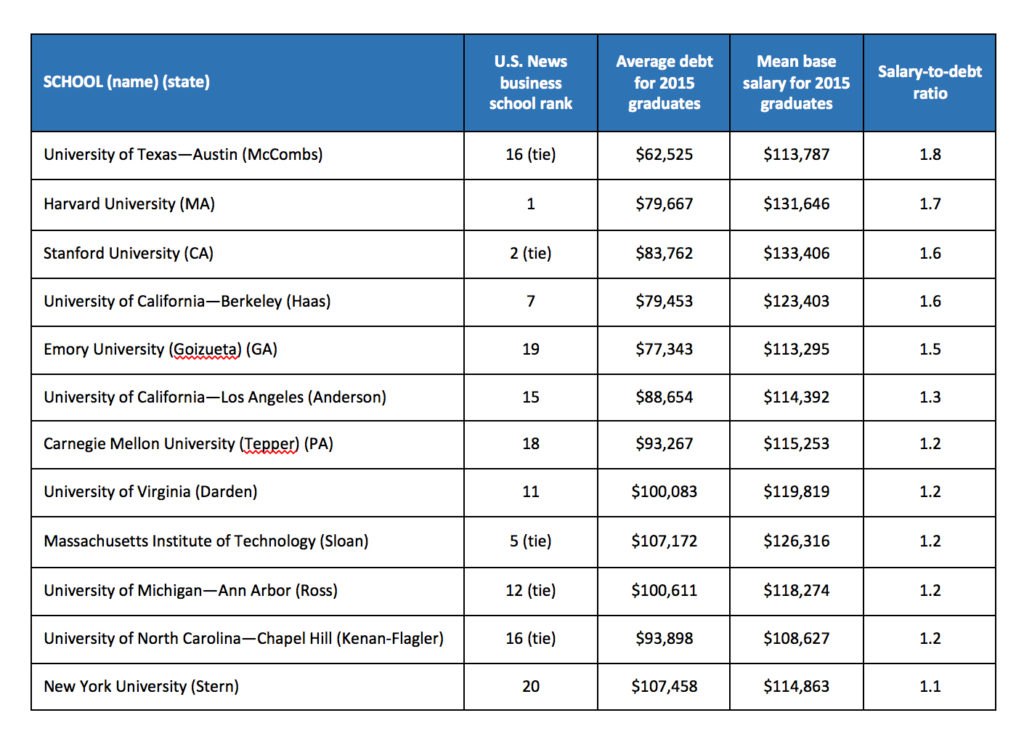

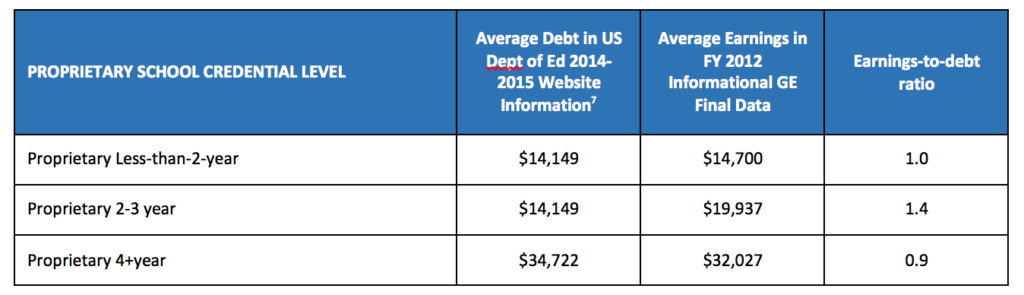

To get an accurate assessment of results we must compare the average debt and starting earnings for the proprietary sector to the top business school graduates, like the following which was published in the U.S. News and World Report. [6] Note there is little difference in the debt-to-earnings ratios as calculated in the referenced article. (Reference information notes “The salary and debt data in this chart are accurate as of June 30, 2016.”)

Keeping in mind that those are the “BEST” ratios for top-rated business schools, the proprietary sector ratios below are comparative and based on publicly available data as documented in my 312-page investigative report, Injustice for All, that provides analysis of sector-level performance and has been audited in Independent Accountants Reports for accuracy. (Injustice for All is available at www.MaryLynHammer.com)

As you can see, the earnings/salary to debt ratios for proprietary schools is very similar to those of the top business schools when calculated as U.S. News and World Report provided.

Additional publicly available data shows similar patterns—where proprietary schools are comparable to public institutions.

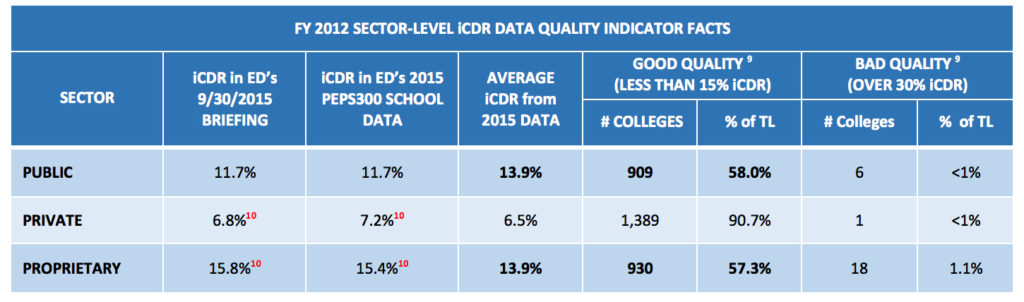

The quality indicators [8] for sector-level performance based on FY 2012 institutional cohort default rate (iCDR) data (2015 PEPS300 data file) released in September 2015 show that the public and proprietary sectors have almost identical statistics for good quality indicators.

- The public sector has 909 colleges with iCDRs under 15% which is 58.0% of all public sector colleges with at least 30 borrowers in their iCDRs.

- The proprietary sector has 930 colleges with iCDRs under 15% which is 57.3% of all proprietary sector colleges with at least 30 borrowers in their iCDRs.

- When the default rates are averaged, giving each institution equal consideration, the public and proprietary sectors have the exact same average iCDR of 13.9%.

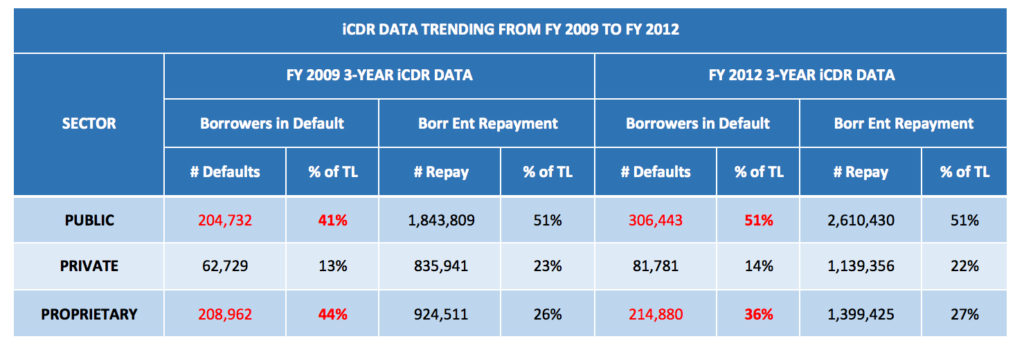

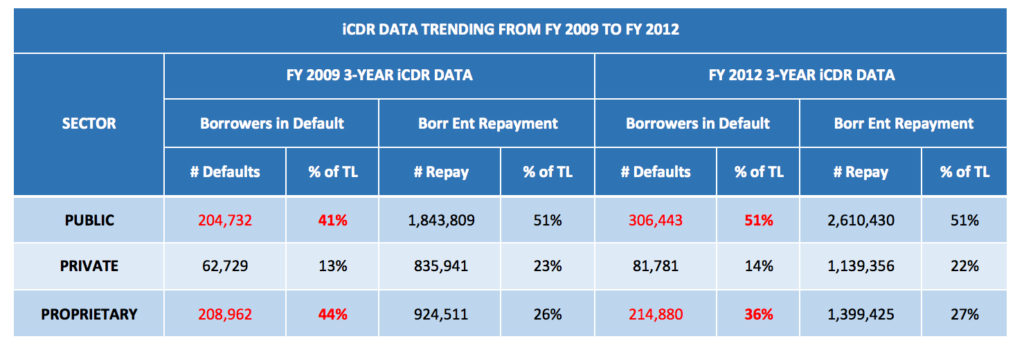

The iCDR trends over the last four years show that the public institutions have rapidly escalating numbers of students in default and in their percent of total defaults nationwide while the proprietary sector has shown a significant reduction in its percent of total defaults. In fact, the proprietary sector is the only sector that shows a decrease in the percent of total borrowers in default over the last four years.

- Public sector defaults increased from 41% of total to 51% of total defaults while the percent of total borrowers in repayment remained at 51% indicating escalating

- Private sector defaults increased from 13% to 14% of total defaults while the percent of total borrowers in repayment decreased from 23% to 22% indicating escalating

- Proprietary sector default decreased from 44% to 36% of total while the percent of total borrowers in repayment increased from 26% to 27% indicating decreasing

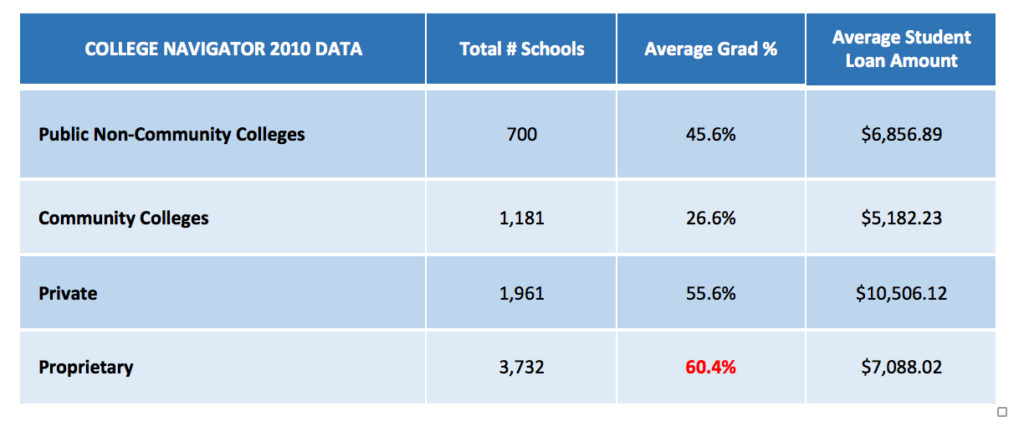

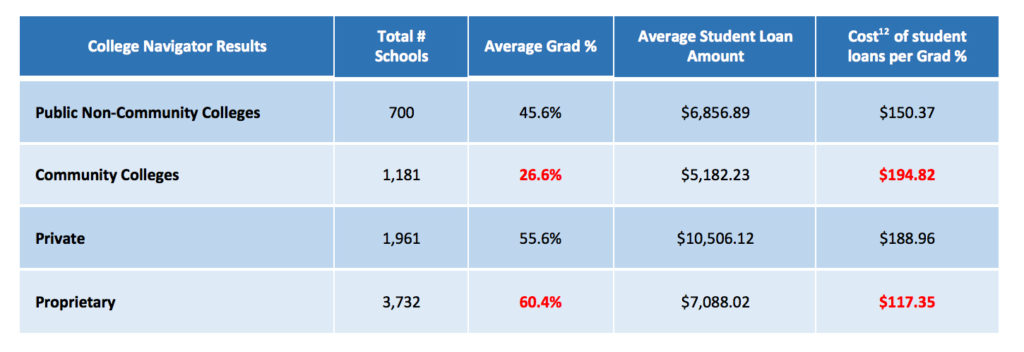

The College Navigator hosted by the Department provides extensive information about schools. The 2010 data available at the time I completed my analysis shows that the proprietary sector has the highest graduation rate among all sectors. The average federal student loan amount for proprietary schools, based on its actual funding levels, shows that the loan balance is reasonable especially considering a 60.4% graduation rate. When compared to community colleges serving a similar socio-economic student group, the proprietary loan amount is comparatively lower considering that the sector graduates more than twice as many students as community colleges.

Why is all of this relevant to this NPRM?

Because this “Defense to Repayment” regulation that has been promoted by the Department is not based on accurate reporting or verified data—its support is based on inaccurate reporting and data manipulation to drive an agenda to eliminate for-profit institutions—an agenda that has nothing to do with ensuring quality education for students. An agenda that has also been alluded to by elected officials and media outlets.

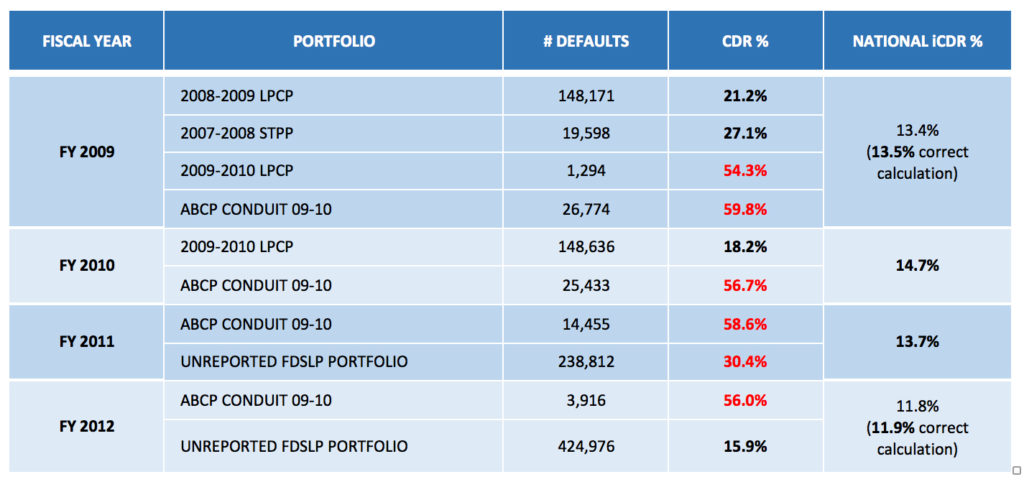

Accurate FACTS about Sector-level Performance

1. For the last four years, certain federal student loan (conduit) portfolios purchased from the private sector are now managed by the Department and have had default rates well above the national average with some just under 60%. The Department ruined the financial standing of several hundred thousand student borrowers during these conduit purchases and the transition to 100% direct lending by mismanaging these students’ loans. Many of these students were actually in good standing on their loans when they were transferred from private lending agencies to the federal government’s management and were almost immediately put into default because the current status didn’t properly transfer.

When I notified Department officials of these colossal errors right when they began occurring, yet the Department did not correct this problem and allowed the financial reputations of these students to be ruined. Additionally, colleges have suffered consequences and tarnished reputation from default rates based on these defaults that wrongly occurred.

There is strong reason to believe that the Department “adjusted” cohort default rates for those schools in jeopardy of losing Title IV funding to avoid loan servicing appeals that would have exposed these unacceptably high default rates that resulted from poor and inappropriate loan servicing.[11]

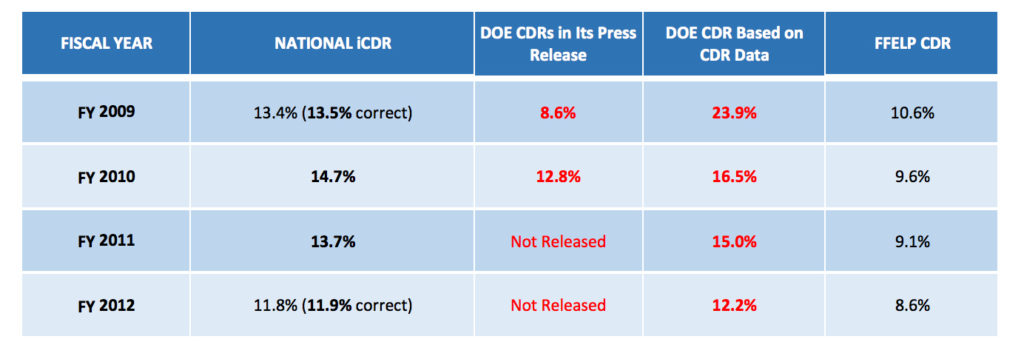

NOTE: ED miscalculated numerous cohort default rates in its Official National Briefings. I have provided the published rate and the correct calculation.

If this regulation is about protecting students, then why hasn’t the Department addressed the defaults that never should have occurred? If the Department thought the errors were important enough to adjust CDRs, then why wasn’t it important enough to include a solution in this regulation for the student borrowers and the schools they attended?

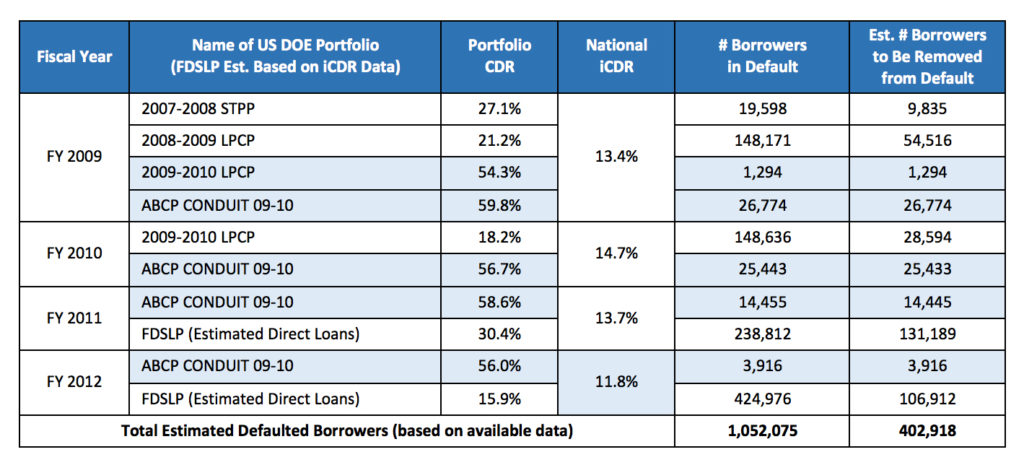

The estimated numbers of adversely affected borrowers to be removed from default are as follows:

For borrowers included in those US DOE loan portfolios with default rates in excess of the national average based on the iCDR (PEPS300) data, we have estimated the difference as the number of borrowers who should be placed back into current repayment status.The borrowers included in those US DOE loan portfolios with default rates in excess of 50% are “presumed innocent” so all of these loans will be placed back into current repayment status. While there is risk that some of these borrowers may go back into default, there is a higher probability that they will have learned from the experience of being in default and will place greater importance on not going into default again.

These estimates are based on publically available data. There may additional claims for subsequent non-public CDRs.

We believe that these corrections will be scored as a cost savings under federal budget methodology because fees and associated costs for defaulted loans are higher than fees for collecting loans in repayment; many of these borrowers have loans with more than one collection or servicing company so by moving them all to one servicer duplicate fees will be eliminated; and the correction for positive credit scores and the elimination of financial burdens for these borrowers will stimulate the economy by hundreds of thousands of people as they find financial stability.

We must implement Solutions for Students, Schools, and Taxpayers

1. The Department has failed to address the borrower defense for those student and parent federal student loan borrowers who inadvertently went into default status as a result of portfolio transfer problems and loan servicing issues during and since the transition to 100% federal direct lending that began on July 1, 2010. The situations addressed herein outline circumstances that incorrectly placed federal student loan borrowers into default status. The Department should reverse the incorrect default status and put affected loans back into good standing; rectify adverse financial consequences wherever possible; correct the borrower’s credit record by removing adverse reporting to the major credit bureaus; and correct relevant cohort default rates (CDR) at the institutional level (iCDR) and programmatic level (pCDR).

Loans affected by this include but are not limited to the following:

a. Those Federal Family Education Loan Program (FFELP) student loans that were purchased by or transferred to the US DOE and subsequently placed into default status for the following US DOE loan holder portfolios shall be removed from default status within 60 days of publication; shall be placed in current repayment status with the federal loan servicer that already services the borrower’s current loans, if applicable; shall be given a credit towards principal reduction for all interest, penalties, and collection fees that should never have been assessed; and shall have negative credit information removed from the borrower’s credit history.

• 2009-2010 LPCP with an FY 2009 iCDR of 3% (1,294 borrowers in default)

• ABCP CONDUIT 09-10 with an FY 2009 iCDR of 8% (26,774 borrowers in default)

• ABCP CONDUIT 09-10 with an FY 2010 iCDR of 7% (25,443 borrowers in default)

• ABCP CONDUIT 09-10 with an FY 2011 iCDR of 6% (14,455 borrowers in default)

• ABCP CONDUIT 09-10 with an FY 2012 iCDR of 0% (3,916 borrowers in default)

• Any subsequent student loan defaults for the ABCP CONDUIT 09-10 loan portfolio

b. Those student and parent federal student loan borrowers who had at least one loan in good standing for a period of at least 60 consecutive days during the FY 2009 3-year iCDR or any subsequent iCDR servicing year and who also had at least one defaulted loan in the same period shall have all applicable loans removed from default status within 60 days of publication; shall be placed in current repayment status with the federal loan servicer(s) that already services the borrower’s loans, if applicable; shall be given a credit towards principal reduction for all interest, penalties, and collection fees that should never have been assessed; and shall have negative credit information removed from the borrower’s credit history. This includes both FFELP and Federal Direct Student Loans in general as well as those included in the following loan holder portfolios in particular:

• 2007-2008 STPP with an FY 2009 iCDR of 1% (19,598 total borrowers in default)

• 2008-2009 LPCP with an FY 2009 iCDR of 2% (148,171 borrowers in default)

• 2008-2009 LPCP with an FY 2010 iCDR of 2% (148,636 borrowers in default)

• FDSL Program with an estimated FY 2011 iCDR of 4% (238,812 borrowers in default)

• FDSL Program with an estimated FY 2012 iCDR of 9% (424,976 borrowers in default)

c. Those student and parent federal student loan borrowers who were included in loan portfolio transfers and had loans go into default as a result of incomplete or inappropriate loan servicing beginning on July 1, 2010, shall have the right to apply for a borrower defense claim to immediately relieve them of the burdens of default and rehabilitate their loans without the normal course of action.

i. Borrowers can request such claim through any federal student loan servicer or third-party collection company.

ii. Applicable federal loan servicers and collectors are to provide copies of all loan servicing history for all relevant accounts within 30 days of the borrower’s request;

iii. Should illegible or incomplete records be provided from the date the borrower’s first disbursement was made through the date of the claim, the borrower shall be presumed innocent of the student loan default and will be removed from default status within 60 days of the claim date; shall be placed in current repayment status with the federal loan servicer that already services his or her loans, if applicable; shall be given a credit towards principal reduction for all interest, penalties, and collection fees that should never have been assessed; and shall have negative credit information removed from the borrower’s credit history. This includes both FFELP and Federal Direct Student Loans.

d. Those federal student loans removed from default for any circumstance outlined in sections 1-3 above shall also be removed from the cohort default rates (CDR) for institution eligibility (iCDRs) and program eligibility (pCDRs) for the relevant institution(s). Based on these loan default adjustments, if an institution no longer faces loss of eligibility at an institutional or programmatic level or faces any other adverse action, those applicable sanctions and actions shall be removed and the corrected status shall be backdated to the date the institution became ineligible based on the inappropriate CDRs.

2. The Department’s press releases for 3-year cohort default rates (CDR) have not matched the data for the last four years, which is every 3-year CDR that has been released. The press releases have consistently underreported public sector defaults and over-reported proprietary sector defaults, giving the illusion that the proprietary sector is performing much worse than it actually is.

• For FY 2009, the Department reported that the public sector had 33,283 fewer defaults than the proprietary sector. The iCDR data shows that the public sector actually only had 4,230 fewer defaults than the proprietary sector.

• For FY 2010, the Department reported that the public sector had 26,427 fewer defaults than the proprietary sector. The iCDR data shows that the public sector actually had 3,881 more defaults than the proprietary sector.

• For FY 2011, the Department reported that the public sector only had 3,886 more defaults than the proprietary sector. The iCDR data shows that the public sector actually had 27,494 more defaults than the proprietary sector.

• For FY 2012, the Department reported that the public sector had 66,069 more defaults than the proprietary sector. The FACT is the FY 2012 iCDR data released in September 2015 shows that the public sector has 91,563 more defaults than the proprietary sector. The Department’s misreported numbers also resulted in reporting the FY 2012 proprietary sector default rate as 15.8% when data shows it to be 15.4%.

While the Department has tried to explain that these changes in numbers are the result of iCDR adjustments and appeals, they have also said that the briefing (press release) information and data are all pulled from the NSLDS. Since the information is pulled approximately on the same date, approved adjustment data should be reflected in both the press release information and the iCDR data. (Please, refer to the attached December 29, 2015 letter from the Department to John Kline, Chairman of the House Committee on Education and the Workforce.)

If the Department’s explanation of adjustments and appeals really supported the difference between the briefings and the data were true—are they, then, expecting us to believe that the proprietary sector is performing adjustments and appeals that increase their default rates? For example, the FY 2012 briefing showed a proprietary sector iCDR of 15.8% while the data shows it as 15.4% but the information was supposedly pulled in proximity of time.

3. The iCDR trends over the last four years show that the public institutions have rapidly escalating numbers of students in default and in their percent of total defaults nationwide while the proprietary sector has shown a significant reduction in its percent of total defaults. In FACT, the proprietary sector is the only sector that shows a decrease in the percent of total borrowers in default over the last four years.

• Public sector defaults increased from 41% of total to 51% of total defaults while the percent of total borrowers in repayment remained at 51% indicating escalating

• Private sector defaults increased from 13% to 14% of total defaults while the percent of total borrowers in repayment decreased from 23% to 22% indicating escalating

• Proprietary sector default decreased from 44% to 36% of total while the percent of total borrowers in repayment increased from 26% to 27% indicating decreasing

To use a truism, when the cats away the mice will play…in other words when only one sector is focused upon, the other sectors start showing trends that do not serve the students’ best interest or the federal fiscal interest. As you can see, these iCDR trends support the need for consistent oversight of all sectors.

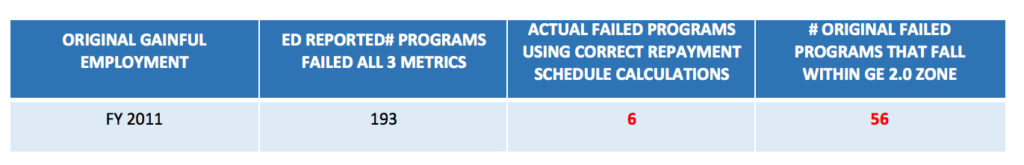

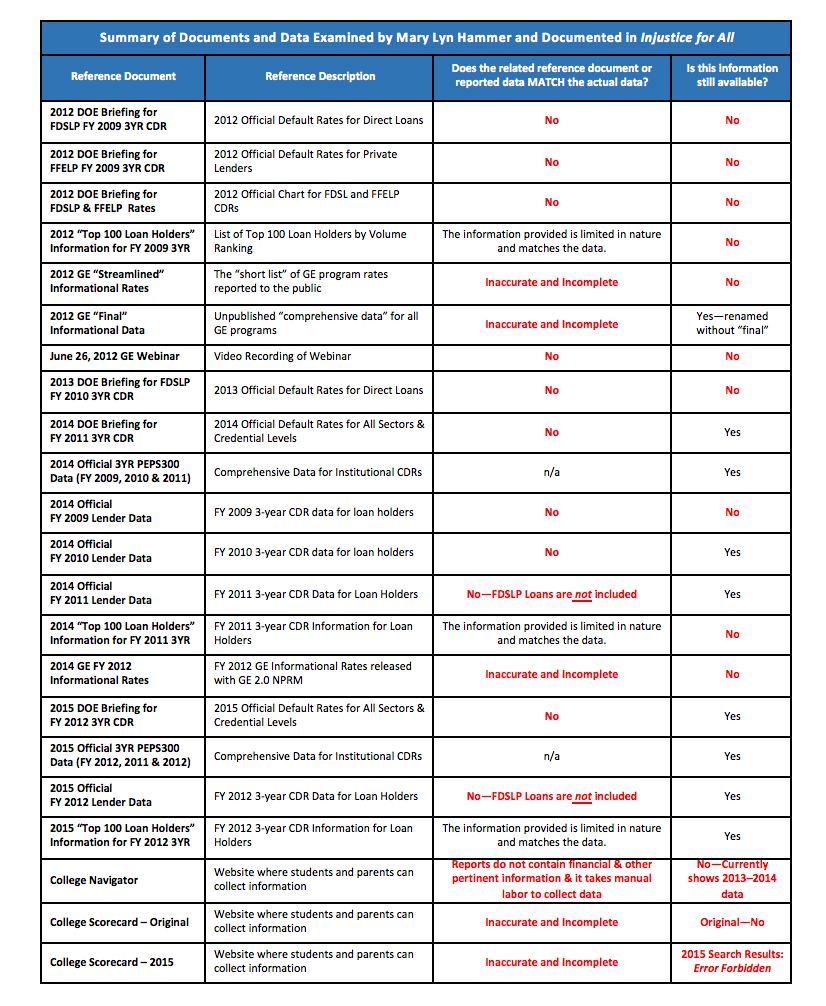

4. The Department has misreported debt-to-earnings rates for both for-profit proprietary institutions and for public institutions. The Department appears to have manipulated data to eliminate reporting for most non-profit programs (less than 5% reported) and to show lower debt-to-earnings rates at public institutions and higher debt-to-earnings rates at for-profit institutions than data actually shows. The original gainful employment (GE) “final” data shows that the Department grossly exaggerated the annual payments for most proprietary programs—and when the payments were properly calculated, there were only 6 failing proprietary programs, not the 193 that the Department reported. Since 56 of these failing programs would fall within the “zone” eligibility criteria, this is likely the catalyst for the less-forgiving second round of gainful employment regulations. The misreported gainful employment information swayed public opinion in favor of non-profit schools and against for-profit proprietary schools when most non-profit schools are not held to the same quality standards.

On the FY 2012 GE Information Rates the Department did not include the “median debt” needed to verify the accuracy of the FY 2012 gainful employment informational rates released with the notice of proposed rulemaking for gainful employment 2.0 published in March 2015. Could this lack of transparency be another indicator of inaccurate and manipulated GE rates?

5. The College Navigator hosted by the Department provides extensive information about schools but the downloadable reports exclude all financial information and are not available in an inclusive data set—the information must be pulled manually to see that the proprietary sector represents the highest graduation rates at the lowest student loan costs for students. Again, is this lack of transparency another way to cover up the truth about sector-level performance?

The FACTS in this difficult-to-obtain data show that the proprietary sector is the highest performing sector with a 60.4% graduation rate provided at the lowest student loan cost of $117.35 per graduation percentage and the loan amount is reasonable especially considering the sector graduates more than any other sector (graduates have higher loan balances than dropped students). Is this the reason why the financial information is not available in the College Navigator standard reports or in any database?

6. The original College Scorecard originally hosted on whitehouse.gov did not include all schools, was missing information for many of those reported, and included misleading information for others. This data was removed from the website within a month of my first speech about the inaccurate information (This page can’t be displayed). The 2015 College Scorecard data released in September 2015 also became unavailable. (Error: Forbidden) Well, at least, that’s the error code that I get when seeking information from the new College Scorecard—others have told me they have access to the information. (See screenshots below.)

7. Similar patterns of misreporting and underreporting have been documented for loan program CDRs for FY 2010 – FY 2012. The truth is that even with diminishing returns, the FFEL Program is performing MUCH better than the FDSLP and portfolios managed by ED.

NOTE: ED miscalculated numerous cohort default rates in its Official National Briefings. We have provided the published rate and the correct calculation.

In Closing

What is shocking is that there is more! I have documented extensive evidence in Injustice for All[13]. Could you please explain to us how this many consistent errors in reporting be coincidental? Is the inaccurate reporting across many federal higher education databases and used to assault and defame proprietary schools actually a deflection from the Department’s own poor performance in higher education?

I have written to the Department about my concerns—with no response. I have provided both written and oral testimony about the inaccuracy of the gainful employment rates, data and calculations—with no response. Before this very damaging proposed regulation is put into final rule, I and every other taxpayer deserve to know why the Department’s reporting does not match its own data.

Americans are quickly losing their freedom to choose which college they want to attend and are being forced into public education systems that are often substandard but look appealing because they come with the promise of “free” education. Until Congress and the Department hold ALL institutions to the same quality standards as the proprietary schools, students attending them are not guaranteed a quality education.

Many high-performing proprietary schools provide valuable training that is critical to the American economy through trades like welders, electricians, the medical industry, auto mechanics, cosmetology careers and more. If proprietary schools are eliminated, many students will be on the street or have limited options for educational training.

While there are some colleges in every sector of higher education that need to be held accountable for breaking rules and laws, the public and proprietary sectors below show almost identical statistics for good quality indicators—something that the Department has worked very hard to keep out of the public’s eye.

Very strong audited evidence shows that the Department’s consistent misreporting is aimed at defaming proprietary schools and has little to do with ensuring quality education for Americans. If there is another explanation, I, as an American citizen and taxpayer, would like to know what it is.

Your timely and through response to the many points I have addressed and the reason that the Department has strayed so far from its original mission will be greatly appreciated.

Sincerely,

Mary Lyn Hammer

American Citizen and Taxpayer

Enclosures:

- 20151229 ED CDR Response to Chairman Kline 11-3-15 Letter.pdf (electronically)

- Injustice for All (Manifesto) Extract for Comments.pdf (electronically)

- Injustice for All (The entire special report will be submitted by mail)

NOTE: This testimony will also be provided via mail delivery along with a copy of Injustice for All for the Department’s review.

NOTES

[1] http://www2.ed.gov/about/overview/mission/mission.html

[2] Source: http://legal-dictionary.thefreedictionary.com/fraud

[3] Source: http://www.wsj.com/articles/obamas-student-loan-writeoff-1466119031

[4] Source: http://www.wsj.com/articles/the-for-profit-kill-zone-1466638683

[5] Source: http://www.theblaze.com/contributions/obama-wants-to-wreck-for-profit-education-and-the-mainstream-media-want-to-help/#

[6] Source: http://www.usnews.com/education/best-graduate-schools/top-business-schools/articles/2016-07-20/see-the-average-debt-starting-salaries-for-business-school-graduates?int=95a608

[7] https://www.studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action#section1

[8] These statistics have been verified for accuracy in Independent Accountant Reports as published in Ms. Hammer’s investigative report, Injustice for All, available at www.MaryLynHammer.com.

[9] Includes schools with 30 or more borrowers in the iCDR.

[10] ED’s press release for official FY 2012 iCDR rates for the private and proprietary sectors did not match their available data for the same.

[11] http://www.wsj.com/articles/u-s-officials-adjusted-21-schools-student-loan-default-rates-1461968091

[12] I manually collected the 2010 academic year financial data available in the College Navigator at the time that Injustice for All was written. I took the sector-level average student loan amount divided by its average graduation rate to get an apples-to-apples comparison of the *cost of student loans for students per graduation percentage.

[13] These facts and more are documented within Injustice for All—backed by Mary Lyn Hammer’s expert analysis of publicly available data and reports and verified for accuracy in “Independent Accountants’ Reports” conducted by Kaiser & Carolin, P.C.

Biography of Mary Lyn Hammer

Ms. Mary Lyn Hammer’s belief that education is the vehicle for making dreams come true has led her in a passionate fight, beginning in 1987, rectifying problems in the higher education industry to insure future participation for all students.

During her career in higher education, Ms. Hammer has touched more than 3 million students’ lives through her companies and a nation of students through her advocacy work in higher education.

Ms. Hammer has worked closely with Congressional Representatives and key staff at the U.S. Department of Education on many issues over her 28+ year career in the higher education industry to insure program integrity and access to low income students.

Ms. Hammer’s experience specific to the contents of this evidence include the following:

- 1988-1989 Hammer turned evidence over to Congress and the U.S. Department of Education (USDOE) and testified numerous times regarding a student lending corruption ring in California that put several companies out of business and cost the government an estimated $750 million to rectify.

- 1989 Her innovative “Hands On” Default Management Program was recognized by the USDOE for its remarkable results and was used as the basis for default management in what became known as “Appendix D”. Hammer was active in aiding the USDOE in drafting this regulatory language for default management that was mandatory for high default rate schools from 1989 until 1996 and still exists today in rewritten regulations under “Subpart M” and “Subpart N”.

- 1990-1993 As part of several laws affecting higher education and cohort default rates, Ms. Hammer helped draft statutory and regulatory language for cohort default rate (CDR) appeals.

- 1993-1995 She helped draft the Cohort Default Rate Guide and several revisions over the years.

- 1994-1998 Hammer worked with Congressional members on school-based loan issues and cohort default rate matters that became statutory language in the 1998 reauthorization of the Higher Education Act of 1965.

- 1999 She served as an alternate negotiator for school-based loan issues in the 1999 Negotiated Rulemaking.

- 2000 She served as a primary negotiator for school-based loan issues in the 2000 Negotiated Rulemaking. The original default management regulations under “Appendix D” were rewritten into “Subpart M” in addition to other loan issues.

- 2002-2008 Hammer worked with Congressional members on school-based loan issues and cohort default rate matters. Although she was opposed to increasing the cohort default rate (CDR) definition, she was instrumental in correcting what was originally written as a 4-year CDR definition to a 3-year CDR definition and helped draft the increased threshold and appeal rights for sanctions under the new definition.

- 2009 She served as a primary negotiator for Loan Issues – Team 2 and provided expert witness testimony for Team 1 Loan Issues. Default management regulations were written into “Subpart N” for the 3-year CDR definition along with conforming language for appeals in addition to other loan issues.

- 1988-2015 Hammer has testified many times at Congressional and USDOE hearings and has worked closely with Congressional members, education committee professional staff, and key staff at the USDOE on many issues during her career in higher education to ensure program integrity and access to quality higher education for at-risk students. Why? Because Mary Lyn Hammer was an at-risk student herself.

Ms. Hammer is the Owner, Founder, President and CEO of Champion College Services, Inc. Champion offers default prevention for Federal and private student loans, job placement verification, skip tracing, consulting services, and custom surveys for students, alumni, and employers. She specializes in staff training, program development, and default prevention operations. She has participated in training sessions and workshops for numerous state, provincial, regional, national, and private associations in both the U.S. and Canada in a continued effort to share her experiences and knowledge.

Her accomplishments include numerous state, regional, and national awards and recognitions over the years in both the higher education industry and in professional business arenas. Ms. Hammer has served on as a board member for numerous education associations, coalitions and groups. She has had hundreds of articles published in numerous higher education magazines over the years. She is an avid supporter of the Imagine America Foundation, a provider of need-based college scholarships.

Mary Lyn Hammer, Founder, President & CEO

Champion ColEDGE Solutions – Quality Default Prevention and Services since 1989

Champion Empowerment Institute, LLC – Life Skills and College Success Training

Champion for Success, Inc., a nonprofit corporation – Mentoring Youth from High School through College

Camp Champion – Where Nature and Teamwork Cultivate Champions!

Read Champion’s Comments on Negotiated Rulemaking for Higher Education 2015-2016

Defense to Repayment Regulations: June 2016

Champion Comments Submitted on Regulations.gov July 26, 2016

go now >>