2016 CDRs Two-thirds of Remaining For-profit Colleges Have CDRs Less Than 15%

Why is the U.S. Department of Education continuing to systematically execute proprietary schools when the Department’s 2016 Official Cohort Default Rate (CDR) Data shows that two-thirds (2/3) of the for-profit schools left standing have CDRs LESS THAN 15%?

October 6, 2016—Phoenix, AZ

FROM THE DESK OF MARY LYN HAMMER

The 2016 Official FY 2013 Cohort Default Rates were released on September 28, 2016. The official briefing is the U.S. Department of Education’s (ED) “press release” for the rates and a data filed called a “PEPS300” file contains the data for those schools included in the rates. Mary Lyn Hammer, a pioneer in student loan default management, education advocate and industry expert said: “Each year, I analyze the data that is contained in ED’s press release at a sector-level. For the purpose of accurate reporting, I have removed the CDR data for those schools that have already gone out of business or have announced that they will be going out of business. Americans have the right to see an accurate picture of exactly what is going on today as that will affect the future of education.”

Ms. Hammer found that this year’s FY 2013 3-year CDR data shows the following trends and results for GOOD quality indicators:

Public: 4 schools or 0.3% of total

Private: 59 schools or 4.0% of total

Proprietary: 23 schools or 1.5% of total

Schools with CDRs less than 15%

Public: 907 schools or 57.7% of total

Private: 1,363 schools or 92.1% of total

Proprietary: 1,016 schools or 65.8% of total

The trending from last year over this year shows that the for-profit sector’s good quality schools is growing from the FY 2012 CDR with 930 schools (57.7%) to the FY 2013 CDR with 1,016 schools (65.8%) while the public sector has remained relatively the same from the FY 2012 CDR with 909 schools (58.0%) to the FY 2013 CDR with 907 schools (57.7%).

When we compare the public sector to the proprietary sector, the for-profit schools are outperforming the public schools by a significant number of institutions and by percent for CDRs less than 15%, which is a good quality indicator.

Public: 908 schools or 57.7%

Proprietary: 1,016 schools or 65.8%

So, why is ED continuing the assault on the for-profit sector?

This year’s FY 2013 3-year CDR data shows the following trends and results for GOOD quality indicators:

Schools with CDRs over 30%

Public: 21 schools or 1.3% of total

Private: 4 school or 0.3% of total

Proprietary: 37 schools or 2.4% of total

Schools with CDRs over 40%

Public: 1 school or 0.1% of total

Private: 1 school or 0.1% of total

Proprietary: 5 schools or 0.3% of total

Schools Subject to Loss of Title IV Eligibility (based solely on the data)

Public: 0 schools or 0.0% of total

Private: 1 school or 0.1% of total

Proprietary: 9 schools or 0.6% of total

ED reported that it “adjusted” CDRs for 11 institutions but it has not released the names of these institutions. ED has also published lists of those schools it says are subject to loss of Title IV eligibility (Federal Direct Student Loans and Pell Grants). Ms. Hammer said: “The information is not accurate and has ruined the reputation of those schools included in the lists when ED KNOWS they shouldn’t be there. For example, the Florida Barber Academy is included in ED’s list of schools with three years over 30% (PEPS304 data) when ED itself has approved economic hardship appeals for this school that allow continued eligibility.”

Why is ED publishing inaccurate lists that can ruin the reputations of the schools included?

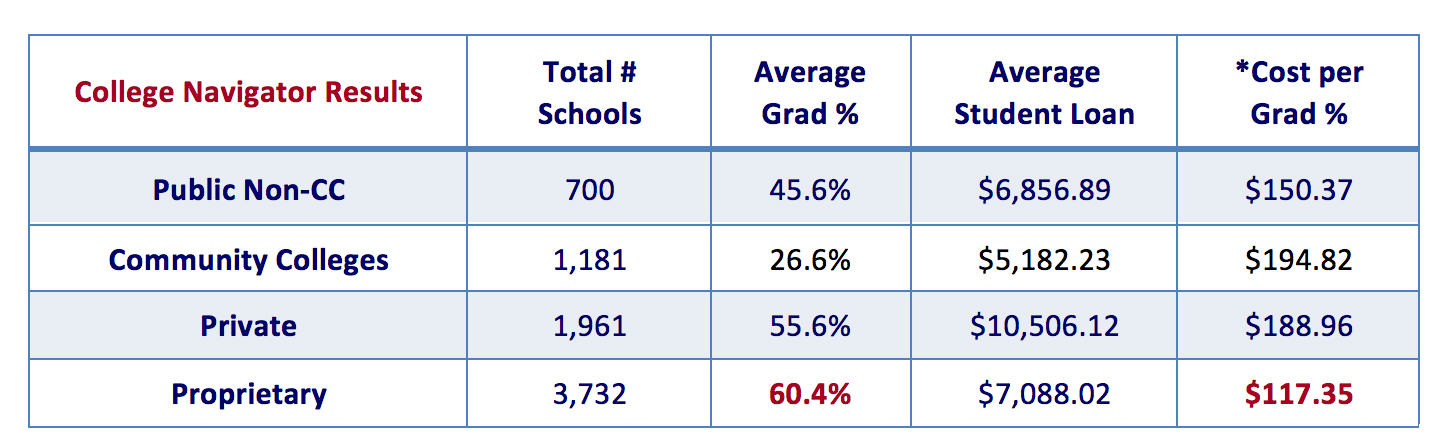

Ms. Hammer asserts: “When we combine the fact that two-thirds of the remaining for-profit institutions have low CDRs with the fact that those schools also have the HIGHEST graduation rates based on data collected from the College Navigator it makes us question what ED is up to and why they are assaulting this sector.” The following chart based on College Navigator data available in 2014–2015 when Ms. Hammer’s research for her 312-page investigative report Injustice for All was completed.

*Cost per Grad %: Does not include costs to taxpayers for state and federal grants and funding that is available to public schools and not available to proprietary schools. When you consider that public non-profit schools receive tax money in the form of state and federal grants and other funding while proprietary schools pay taxes on profits, the cost of proprietary schools is substantially less than public schools. More details are available at http://www.marylynhammer.com/shock-ed/.

Is ED’s assault against the for-profit sector REALLY about protecting students and providing quality education?

And, an equally pressing question is: Will the public sector be ready and able to take over training and educating those students who have been attending for-profit schools being forced out of business?

Ms. Hammer pointed out: “When we look at the FACT that thousands of students have already been displaced from school closures where there was no due process or teach-out plans in place at the time of the closures, Americans MUST ask where more displaced students will go if more for-profit institutions are forced to close their doors. Those institutions that serve primarily at-risk students will be eliminated leaving the at-risk population with little to no options for training and education.”

Here are the facts based on the FY 2013 CDR data of the number of institutions:

Less-than-2-year Institutions

- 127 public institutions serving 11,417 student borrowers (13.1% FY 2013 CDR)

- 24 private institutions serving 4,257 student borrowers (21.1% FY 2013 CDR)

- 793 remaining proprietary institutions serving 139,943 student borrowers (14.8% FY 2013 CDR)

2-3 year Institutions

- 779 public institutions serving 960,883 student borrowers (18.5% FY 2013 CDR)

- 111 private institutions serving 46,965 student borrowers (16.3% FY 2013 CDR)

- 494 remaining proprietary institutions serving 238,904 student borrowers (15.6% FY 2013 CDR—the lowest of all sectors)

4+ year Institutions

- 665 public institutions serving 1,776,189 student borrowers (7.5% FY 2013 CDR)

- 1,343 private institutions serving 1,165,665 student borrowers (7.0% FY 2013 CDR)

- 226 remaining proprietary institutions serving 786,321 student borrowers (13.4% FY 2013 CDR)

Is it realistic to believe that the at-risk students will attend the public and private institutions in this country? And if they do, is it realistic to believe that these public and private institutions will be able to provide quality education to this huge increase in student population?

ED published the Official FY 2013 CDR of 11.3%. As you can see from this data, the proprietary institutions do NOT represent the highest CDRs for the less-than-2-year and 2–3 year subsectors. This year, the public sector represented 311,892 defaulted borrowers compared to the remaining proprietary sector’s 163,110 defaulted borrowers. The public sector’s defaulters are now almost twice as many as the proprietary sector.

Is it realistic to believe that the public sector CDRs will decrease with this influx of students—or will their number of defaulted borrowers continue to drastically increase as they have been over the last five years? Is this the real reason that “free college” at the public schools is being promoted? Is it realistic to believe that these students won’t take out student loans for living expenses while they are receiving this free education? And will taxpayers be left responsible not only for funding the free college tuition but also for the defaulted loans that will occur?

Does ED have VALID REASONS to continue to systematically close the remaining for-profit institutions that provide quality education and training to our at-risk population? Accurate facts based on ED’s own data show a very different reality from what the public has been led to believe about for-profit schools. It’s time to make changes before we reach a crisis-level with students on the street because there are no available schools. This tragedy would leave many at-risk citizens untrained, uneducated and dependent upon public assistance—isn’t that the opposite of what educating America should be?

Mary Lyn Hammer is an expert resource for journalists who need reliable answers to tough questions about how the U.S. government handles student loans, cohort default rates, higher education loan regulations, and the topics of financial literacy and education legislation.

For more information, to obtain a review copy of Injustice for All, schedule an interview, and/or to book Ms. Hammer to speak to your group, please call John White at 480.222.4314 or click here to email your request.